Introduction to Variable Life Insurance

Meet Variable Life Insurance, a permanent life insurance product with an investment component. Known for its flexibility, it allows policyholders to participate in various types of investment options.

Understanding Variable Life Insurance

With Variable Life Insurance, policyholders have control over their investments, creating the potential for higher cash value growth.

Benefits of Variable Life Insurance

Consider its benefits! The policyholder enjoys maximum potential growth, tax benefits, and the ability to adjust the premium payment and death benefits. Truly, Variable Life Insurance offers versatility and control.

Features and Options of Variable Life Insurance

Amid the cluster of insurance options available in the market, Variable Life Insurance strikes a noteworthy position. This policy combines protection with an investment component that allows policyholders some input into how their cash value grows.

Investment Component of Variable Life Insurance

What marks its uniqueness is the investment component, a portion of the premium is invested, offering policyholders a chance to grow their savings.

Flexibility in Premiums and Death Benefits

Variable Life Insurance provides flexibility not seen in other policies. Policyholders have some control over premium amounts and death benefits, giving it a unique blend of versatility and security.

Growth Potential and Investment Options

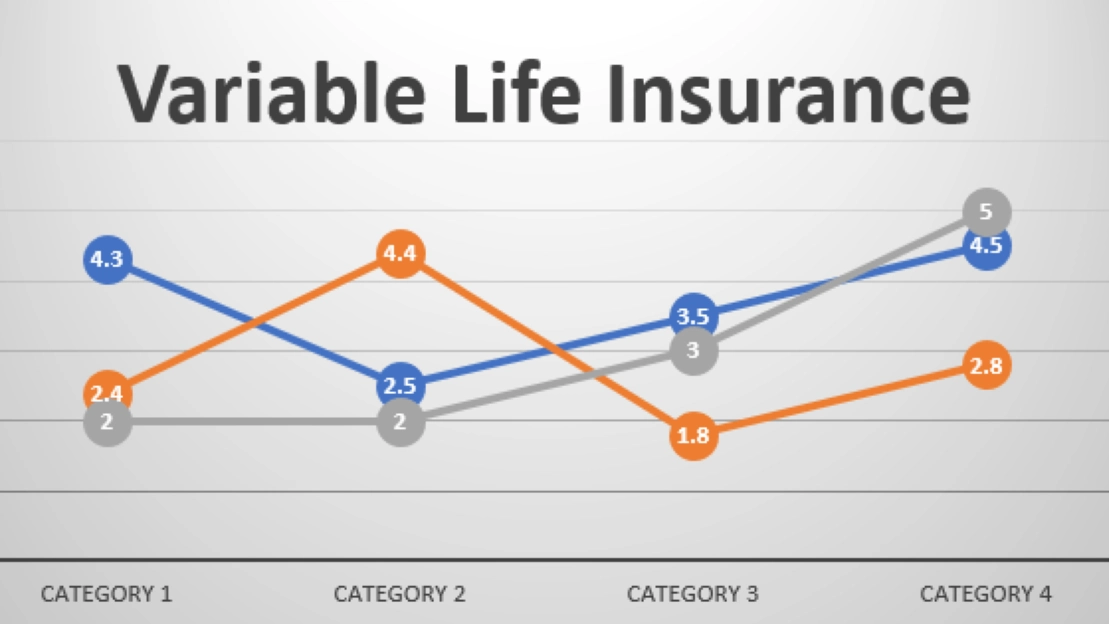

Variable life insurance preens with tremendous versatility which can be chalked up to its investment component, making it quite an attractive option for the financially savvy.

Market Performance and Variable Life Insurance

The allure is its unique ability to let policyholders potentially grow their cash value based on market performance. This feature enables those with a high-risk tolerance to optimize their investments and potentially bolster their policy’s payout.

Different Investment Options Available

One crucial ace in variable life insurance is it opens a variety of investment options – stocks, bonds, and money market accounts. In other words, policyholders have the opportunity to tailor their investment portfolio according to their financial goals and risk appetite.

Risk Management and Policy Adjustments

Entering the world of life insurance, you may discover the versatility and flexibility of Variable Life Insurance. It’s a type of permanent life insurance where the policyholder has the luxury of managing risks.

Managing Risks with Variable Life Insurance

With variable life insurance, policyholders have the advantage of shifting funds between different investment options, providing more control over the investment risks.

Ability to Adjust Death Benefit and Premiums

Furthermore, variable life insurance policies offer the flexibility to adjust death benefits and premiums, accommodating financial changes throughout life, making it a popular choice among savvy policyholders.

Tax Advantages and Estate Planning

When it comes to financial planning strategies, variable life insurance plans play a versatile role. They are not just life protection but come with a unique composition of benefits.

Tax Benefits of Variable Life Insurance

Variable life insurance provides a significant tax advantage. The policyholder can enjoy the benefits of deferred taxes on the growth of the cash value account which accelerates its accumulation of wealth.

Using Variable Life Insurance in Estate Planning

Estate planning becomes more effective when incorporated with a variable life insurance policy. It serves as a valuable tool to seamlessly transfer wealth to the next generation, while mitigating the blow of estate taxes. One can experience the versatility that this policy brings to the table.

Choosing the Right Variable Life Insurance Policy

When it’s time to secure future financial stability, Variable Life Insurance emerges as a versatile yet complex instrument.

Factors to Consider When Choosing a Policy

Picking an adequate policy requires a balance between death benefits and investment goals. Having clear objectives, risk tolerance, and financial capability is crucial.

Comparing Different Variable Life Insurance Options

By comparing various Variable Life Insurance offerings, buyers can identify policies well-aligned with their needs. This can be achieved by examining features like investment choices, fees, and the flexibility of death benefits.

Case Studies and Real-Life Examples

When thinking about variable life insurance, tangible examples often provide a clearer understanding.

Real-Life Examples of Variable Life Insurance Policies

Consider Mr. Smith, a policyholder who invested in a variable life insurance policy. He allocated premiums to various accounts, diversifying between stocks, bonds, and money market options. Over the years, he enjoyed investment gains that increased his policy’s cash value, offering a substantial nest egg.

How Variable Life Insurance Helped Individuals and Families

Then, there’s Mrs. Robinson, a mother and policyholder who sadly passed away. Thanks to her variable life insurance policy, her family received a death benefit payout that not only covered funeral expenses but also helped secure their financial future. This practical application of variable life insurance illustrates how it can provide an invaluable safety net.

Common Questions and Misconceptions

When it comes to matters of insurance, especially something as multifaceted as variable life insurance, questions and misconceptions aren’t unusual.

Frequently Asked Questions about Variable Life Insurance

Among the mix of insurance products available, variable life insurance stands out with its hybrid features of both insurance and investment. The common queries range from its unique benefits to what potential drawbacks it may entail.

Addressing Common Misconceptions about Variable Life Insurance

Talking about misconceptions, there’s a fair share surrounding variable life insurance. It’s seen by some as too complex or risky, but a closer look reveals its dynamicism, designed to offer flexibility and potential prosperity. It’s about time these misconceptions are set straight to reveal the true potential of this versatile policy.

Conclusion

An area that is gaining recognition among intelligent savers and investors is Variable Life Insurance. Life isn’t a series of certainties and this applies across the spectrum, from everyday life to financial planning.

The Versatility and Benefits of Variable Life Insurance

The core of a variable life insurance policy is defined by its versatility. Termed as the Swiss Army Knife of the insurance world, it harmoniously combines insurance protection and investment opportunities. This feature allows policyholders the flexibility to adjust their premiums and death benefits, catering to different life stages and financial goals. It’s a win-win solution that could work wonders for your financial planning.

GIPHY App Key not set. Please check settings