Title: When to Consider Liquidating a Corporation: An Overview

Introduction:

To liquidate or not to liquidate? That is the question that corporate executives and business owners often grapple with when facing tough times or life-changing decisions. Whether due to bankruptcy or major business restructuring, liquidating a corporation can be an incredibly complex, emotional, and strategic process. The decision to dissolve a company should never be taken lightly, as the consequences can impact employees, shareholders, and communities. It is crucial for stakeholders to thoroughly assess their situation, understand the legal framework, and consider their financial liabilities before proceeding. In this comprehensive overview, we lay out the essential factors to weigh and delve into when it is time to seriously contemplate liquidating a corporation.

1. Definition of liquidation in finance and economics

2. Circumstances under which liquidation occurs

There are several circumstances under which a corporation may choose to undergo liquidation. These situations typically arise when a company is unable to meet its financial obligations, when a major investor decides to walk away from the business, or when the organization undergoes corporate restructuring. Additionally, liquidation might be considered if the company experiences poor performance or is consistently generating negative cash flow. In these cases, the process of liquidating the business becomes a viable option to minimize further financial loss and move forward from the struggling venture.

Liquidation can also be prompted by both voluntary and involuntary means. In voluntary liquidation, the owners and shareholders of the company make the decision to wind up their business and submit an application to dissolve the company’s identity. This action might be taken to prevent the business from accruing further debt or to maximize the value of the company’s assets before they decline further in worth. In contrast, involuntary liquidation, also known as forced or compulsory liquidation, occurs when a court orders the shutdown of a company, leading to the sale of its assets to compensate creditors. This typically transpires when the corporation is declared insolvent and can no longer pay its debts. Once liquidation has been completed, the company ceases to exist and is removed from the register of companies (ROC). Ultimately, the decision to liquidate a corporation will depend on factors such as financial stability, business performance, and the objectives of the owners and shareholders involved. [3][4]

3. Chapter 7 bankruptcy and liquidation

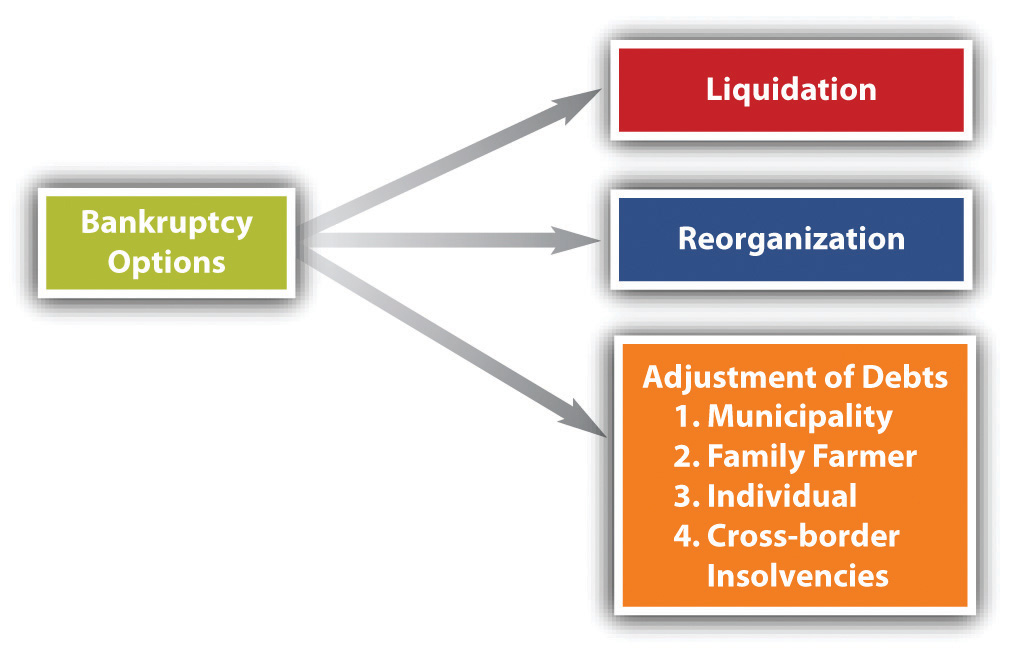

Chapter 7 bankruptcy is a legal process that provides debt relief to individuals, partnerships, and corporations who cannot repay their outstanding debts. When a debtor files for Chapter 7 bankruptcy, their non-exempt assets are liquidated and the proceeds are distributed to the creditors, in accordance with the provisions of the Bankruptcy Code. This process is considered a last resort for those who are overwhelmed by their financial obligations and need a fresh start.

However, it is important to note that Chapter 7 bankruptcy may not be suitable for everyone, as it can result in the loss of property and may not be available to individuals with primarily consumer debts. Those who wish to remain in business or find a more comprehensive solution to their financial challenges should consider filing for Chapter 11 bankruptcy, which allows them to reorganize their debts through a repayment plan or by restructuring their business operations. Sole proprietorships and individuals with regular income may also be eligible for Chapter 13 bankruptcy, which provides debt adjustment through a structured plan and can help save homes from foreclosure.

In the case of a corporation, liquidation under Chapter 7 bankruptcy involves the appointment of a trustee who gathers and sells the company’s non-exempt assets in order to pay off creditors based on their claims’ priority. The company will cease all business operations and the assets’ sale proceedings will be used to cover the debts. If the debtor corporation is unable to fully repay its debts after the liquidation, the shareholders will likely not receive any returns on their investments.

4. Alternatives to liquidation, including Chapter 11 bankruptcy

In certain situations, liquidating a corporation may not be the most feasible solution for a business that finds itself struggling financially. Instead, the company’s management can consider alternatives such as restructuring through Chapter 11 bankruptcy. This option, also known as reorganization bankruptcy, grants a company the opportunity to restructure its debts and continue operations with an ultimate objective of becoming a viable business once again.

The process of filing for Chapter 11 bankruptcy starts with submitting a petition to the bankruptcy court. This can be a voluntary petition filed by the debtor or an involuntary one filed by creditors who want to recover their money. During the restructuring process, the debtor remains in control of its business and works to implement initiatives aimed at stabilizing its finances. Examples of these actions include reducing expenses, selling off assets, and renegotiating debts with creditors under the supervision of a court-appointed trustee.

Chapter 11 bankruptcy offers many benefits to a corporation, such as the ability to continue operating and potentially emerge as a profitable entity. It allows for the continuation of employment for its workers and can lead to the eventual satisfaction of the company’s obligations to its creditors. Additionally, it offers the opportunity for the corporation to restructure its debt and negotiate more favorable repayment terms.

However, pursuing Chapter 11 bankruptcy can be a complex and expensive process, with various legal requirements that must be met, such as credit counseling and obtaining court approval for new loans. This type of reorganization bankruptcy is therefore more commonly opted for by larger businesses and corporations, owing [7][8]

5. Distribution of assets during liquidation

During the liquidation process of a corporation, one of the main steps involves the distribution of assets to shareholders. This process entails allocating the corporation’s remaining property among its stakeholders based on their ownership stakes. The distribution of assets occurs after all outstanding debts and liabilities have been paid off, and often represents the final stage in a corporation’s life cycle. It is essential for both the corporation and shareholders to be aware of the tax consequences and potential gain or loss recognition that may arise from the distribution of these assets.

In general, when a corporation distributes an asset to a shareholder, the shareholder’s stock basis will increase by the gain recognized on that distribution and decrease by the fair market value of the asset being distributed. The gain or loss is typically the difference between the basis (cost) and the fair market value of the asset being sold or distributed. If the fair market value of the asset exceeds the basis, the difference is recognized as a gain, while if the basis exceeds the fair market value, a loss is recognized. The specific tax consequences and liability for both the corporation and shareholders depend on these gains or losses, as well as the types of assets being distributed.

For a completely liquidating corporation, pursuant to the Internal Revenue Code (I.R.C.) §336, gain or loss is recognized as if the property were being sold to the distributee at its fair market value, unless the liquidation is part of a reorganization plan. The shareholder’s stock basis plays an important role in determining the overall [9][10]

6. Priority of claims for creditors and shareholders

In a corporate liquidation, the priority of claims for creditors and shareholders is crucial to ensure a fair and organized distribution of assets. The Bankruptcy Code, under Section 507, outlines the specific order in which creditors are to be paid, aiming to protect those with a direct interest in the liquidated party’s assets. This hierarchy plays a vital role in determining who gets paid first and helps maintain the integrity of the liquidation process.

Secured creditors are usually given the highest priority in a liquidation. These creditors have their claims backed by collateral, such as property or equipment, which provides them with added security. In cases where multiple liens are placed on a single asset, the first lien takes priority over the second one. Following secured creditors are unsecured creditors, who are further divided into preferred and non-preferred categories. Certain unsecured creditors, like employees and tax agencies, are given preferential treatment due to their close association with the debtor.

Preferred creditors include employees with unpaid wages, victims of pending lawsuits against the debtor, and government agencies seeking tax payments. Though they may not hold direct ownership of the company assets, these stakeholders receive priority in the liquidation process. Conversely, non-preferred creditors, such as credit card companies and suppliers, are paid afterward since they lack any specific rights to the debtor’s assets.

Lastly, shareholders are considered in the distribution of remaining assets. Preferred stockholders receive priority over common stockholders due to the nature of their investment. However, it is important [11][12]

7. Liquidation of inventory

Liquidation of inventory is a common strategy used by businesses that need to generate cash or clear out excess stock. This process involves selling inventory items at a significantly reduced price to quickly turn them into cash, which can then be used to pay off debts or invest in new opportunities. Businesses may opt for liquidation sales due to overstocking, seasonal changes, or underperforming products taking up valuable warehouse space.

One notable benefit of liquidating inventory is that it allows businesses to recover some of their initial investment, albeit at a lower return. This quick influx of cash can be crucial for companies facing financial challenges, such as bankruptcy or mounting debt. By selling off inventory at a steep discount, businesses can avoid the more severe consequences of insolvency and strengthen their financial footing.

However, the process of liquidating inventory is not without its drawbacks. Selling items at a fraction of their original price can damage a company’s brand reputation, as customers may become hesitant to pay full price for products in the future. Additionally, liquidating inventory can lead to a loss of profits, as businesses may struggle to recoup the production costs of the discounted items.

Despite these risks, inventory liquidation can be a useful tool for businesses in certain situations. For example, a retailer facing seasonal transitions may hold a sale to clear out merchandise and make room for new, in-demand products. Similarly, a company going through financial difficulties may opt to liquidate inventory to help pay down debts or delay bankruptcy proceedings.

In conclusion, liquid [13][14]

8. Exiting a securities position through liquidation

Exiting a securities position through liquidation is another aspect to consider for investors and traders. This process involves selling off the securities in their portfolio and converting them into cash. This decision typically arises when an investor wants to cash out their investments or when a trader needs to close a position to prevent further losses or to lock in gains. In this context, liquidation can be a strategic move to protect one’s financial interests or to reallocate resources to more compelling opportunities.

There are several reasons why an investor or trader may choose to exit a securities position through liquidation. One common reason is to reduce risk due to market volatility or fluctuations in the value of an asset. In such cases, selling off the positions and converting them to cash allows the investor to avoid potential future losses. Another reason could be the need to raise funds for an unexpected expense or personal financial priority, such as paying for medical bills or college tuition for a child. In this situation, liquidating a portion of the investment portfolio can provide the necessary funds to meet these pressing expenses.

Additionally, an investor may choose to exit a securities position if they have reached their financial goals or targets for a specific asset. For example, if an investor initially purchased shares of a company to achieve a certain return on investment, they may decide to liquidate this position once that goal has been met. In doing so, the investor can lock in their gains and invest the proceeds in another, more promising opportunity.

Traders, on the other hand, might exit [15][16]

:max_bytes(150000):strip_icc()/Term-b-bankruptcy-50ca3cfd9f4146e78eabe03b64704456.jpg)

9. Forcible liquidation by a broker

Forcible liquidation by a broker can occur when a trader’s portfolio has fallen below the required maintenance margin, or the trader has demonstrated a reckless approach to risk-taking. In this situation, a broker may decide to forcibly liquidate a trader’s positions in order to protect both the trader and the brokerage from potential losses. This type of liquidation is often carried out without the consent or prior notification of the trader, as it is done in the best interest of all parties involved.

The process of forcible liquidation typically involves the brokerage closing out the trader’s open positions, starting with the most high-risk positions first, and converting them to cash. The primary goal of this action is to bring the trader’s account back within the required limits of the maintenance margin while minimizing any potential losses to the brokerage. In some cases, the brokerage may also take additional steps, such as increasing the required margin for the trader in the future or terminating the trader’s account if they continue to engage in high-risk trading activities.

Forcible liquidation can sometimes lead to traders experiencing significant financial losses. Hence, it is important for traders to closely monitor their account’s margin requirements and trading activities, ensuring that they maintain the required levels of security and stability. This can prevent forcible liquidation by a broker and safeguard the trader’s investments.

It is also essential for traders to have a solid understanding of the rules and regulations imposed by their brokerage, as well as the implications of margin trading. By familiarizing themselves [17][18]

10. Case study: When to consider liquidating a corporation

In a hypothetical case study, let’s consider Corporation XYZ, which has been operating successfully for over 20 years in the manufacturing industry. However, economic downturns, increased competition, and several financial missteps have led the business to struggle considerably during the past few years. As a result, the corporation’s stakeholders are contemplating the option of liquidating the company, with the possibility of incurring substantial losses.

Before making a decision, Corporation XYZ’s management and shareholders need to closely examine the company’s financial situation and assess the potential tax implications of a liquidation event. Under Section 331 of the US Internal Revenue Code, a liquidating distribution is deemed to be a full payment in exchange for the shareholder’s stock, rather than a dividend distribution based on the corporation’s earnings and profits. The shareholders would generally recognize a gain or loss on this transaction, equivalent to the difference between the fair market value of the assets received (in the form of cash or other property) and the adjusted basis of the stock surrendered.

Additionally, it’s important for Corporation XYZ to understand the double taxation that often results from the liquidation process. The corporation is considered to have sold the distributed assets at their fair market value to its shareholders, thus leading to corporate-level tax liabilities. Meanwhile, the shareholders are considered to have exchanged their stock for the fair market value of the assets distributed in the course of liquidation, leading to gains or losses at their individual level.

Further, Corporation XYZ’s management and shareholders should take into account [19][20]

GIPHY App Key not set. Please check settings