As small business owner, you know how important cash flow is for growth and success. This is where invoice factoring comes in – by selling unpaid invoices to a third party, you can get the capital you need quickly. But before you jump in, it’s crucial to choose the right invoice factoring partner. In this blog post, we’ll provide you with factual data and insights on what to look for in an invoice factoring partner to help you make the best decision for your small business.

I. Introduction

A. Definition of invoice factoring

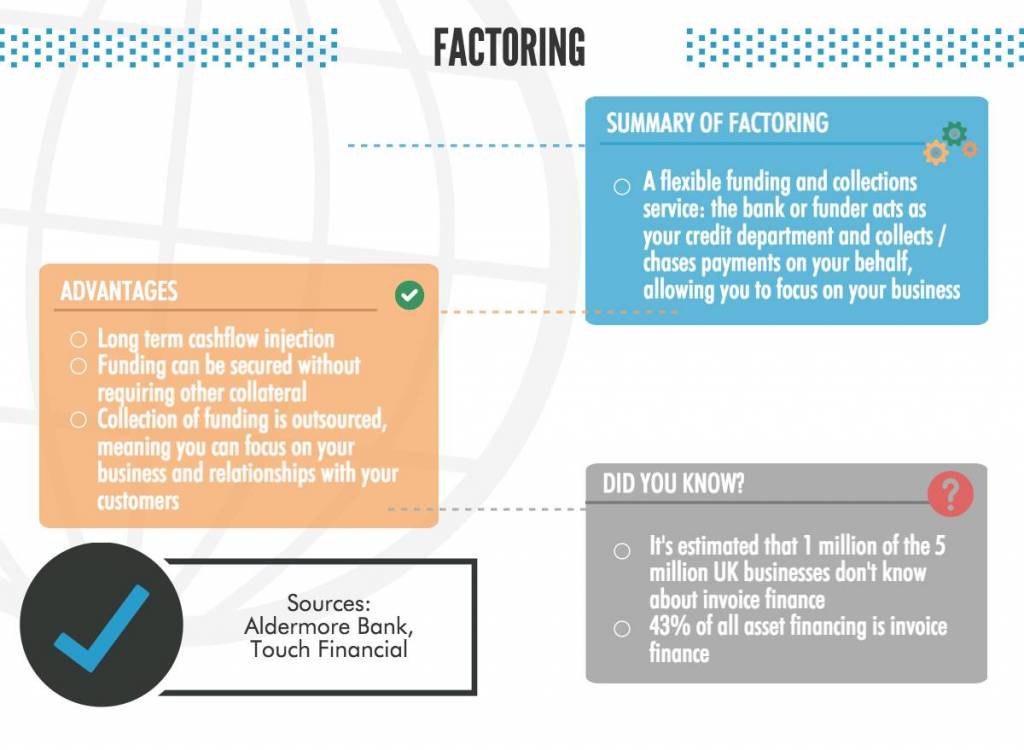

Invoice factoring is a financing method that offers businesses the ability to leverage their accounts receivable to obtain fast cash. Rather than waiting for clients to pay out invoices, businesses can borrow against them through factoring companies. This funding option isn’t always an ideal solution, but it can be especially useful for industries or businesses that struggle to obtain conventional financing. Keep reading to learn more about how invoice factoring works and its benefits for small businesses. [1][2]

B. Benefits of invoice factoring for small businesses

Invoice factoring is a game-changer for small businesses, providing them with an immediate injection of cash through the sale of their sales invoices to a factoring company. This financing option helps businesses manage cash flow, reduce bad debt risk, and focus on growth instead of worrying about late payments. Invoice factoring helps small businesses in many ways, including access to funding quickly and with no impact on their balance sheet. It’s a flexible financing option that doesn’t require a perfect business credit score, and it allows you to offer credit to customers, which can attract new business opportunities. Furthermore, invoice factoring companies can help manage the collections process for you, freeing up your resources to focus on core business activities. [3][4]

C. Importance of choosing the right invoice factoring company

Choosing right invoice factoring company is crucial for the success of your small business. Here are some reasons why:

1. Experience and Reputation: An experienced factor with a good reputation is more likely to provide reliable and trustworthy services that can help your business succeed. Check for their length of experience in the industry and reputation among peers and clients.

2. Funding Limits and Customer Base: Look for a factoring company that provides funding limits that meet your business needs. Also, make sure that they cater to a wide range of customer industries and creditworthiness.

3. Transparency and Ease of Use: Choose a factor that offers transparency in their terms and fees. They should also have user-friendly platforms that make it easy for you to manage your invoices and get quick access to cash.

By taking the time to research and select the right invoice factoring partner, you can improve your cash flow, gain access to working capital, and ultimately help your business grow. [5][6]

II. Qualities to Consider in an Invoice Factoring Partner

A. Experience and Reputation

When for an invoice factoring partner, it’s important to consider their experience and reputation in the industry. Here are some key points to keep in mind:

– Look for a company that has been in business for a long time and has a proven track record of success.

– Check the company’s reputation among their peers and clients. Do they have positive reviews and testimonials?

– Consider if the factoring company is affiliated with a reputable organization, such as the International Factoring Association.

Choosing a partner with experience and a solid reputation can provide peace of mind and help ensure a successful partnership. [7][8]

1. Length of experience in the industry

When choosing an invoice factoring partner for your small business, it’s important to consider their experience and reputation in the industry. Look for a factor that has been in business for many years and has a proven track record of success. This will ensure that the company is knowledgeable about the intricacies and risks associated with different industries and can help you avoid any potential pitfalls. Be sure to ask about the length of their experience in the industry and their reputation among peers and clients. Choosing an experienced and reputable partner can make all the difference in the success of your factoring arrangement. [9][10]

2. Reputation among peers and clients

When choosing a partner for your small business invoice factoring needs, reputation is a crucial factor to consider. A company’s reputation speaks volumes about the level of service you can expect to receive. Look for a company with many satisfied clients who can attest to their reliability, professionalism, and commitment to providing top-notch service. You may also want to consider a company’s reputation among their peers in the invoice factoring industry. A well-respected company with a strong reputation can give you peace of mind knowing that you are partnering with a reliable and trustworthy provider. [11][12]

B. Funding Limits and Customer Base

When an invoice factoring partner, it’s important to consider their funding limits and customer base. Some factors may have limitations on the minimum and maximum amounts of funding they can provide, which may not work for your business needs. It’s also important to look for a partner that has experience working with a range of customer industries and creditworthiness. This ensures that they have the knowledge and resources to handle diverse invoices and customers. Transparency and ease of use are also crucial factors in the decision-making process. Look for a partner who is transparent about their fee structure and processes, and who makes it easy for you to manage your invoices and payments. [13][14]

1. Limitations on minimum and maximum amounts of funding

When considering an invoice factoring company for your small business, it’s important to look at the limitations on minimum and maximum amounts of funding they offer to ensure they align with your business needs. Some companies may have a minimum invoice amount that is too high for your business, while others may not provide funding for large invoices. It’s also important to check for maximum funding limits as some companies may not be able to cover larger invoices. Be sure to research and compare the funding limits of potential invoice factoring partners to find the right fit for your business. [15][16]

2. Range of customer industries and creditworthiness

When an invoice factoring partner for your small business, it’s important to consider the range of customer industries and creditworthiness that the factoring company caters to. Look for a partner that has experience working with a diverse range of industries, including those that are specific to your business. Additionally, ensure that the factoring company has a rigorous customer credit checking system in place to minimize the risk of defaults. By partnering with a factoring company that caters to a wide variety of industries and has a strict creditworthiness system in place, you can rest assured knowing that your invoices are in good hands. [17][18]

C. Transparency and Ease of Use

Transparency and ease of use are key factors when considering an invoice factoring partner. Look for a partner who provides clear and concise communication throughout the entire process, from setting up the agreement to collecting payment from your customers. It’s important to understand all of the fees and charges associated with their service upfront, so make sure your chosen partner provides a transparent breakdown of their costs. Additionally, choose a partner who offers an intuitive, user-friendly platform for submitting invoices and tracking payments. A seamless process with quick access to funding can make all the difference in keeping your business running smoothly. [19][20]

GIPHY App Key not set. Please check settings