Introduction

Reinsurance, a fundamental term in the insurance universe, serves an integral, yet transcendental function. This invisible layer of protection aids insurers against colossal losses.

The importance of reinsurance in the insurance industry

Safeguarding Insurers: Reinsurance primarily functions as a security net for insurers. Through transactions called cessions, it offers insurers a mechanism to spread risk, reducing the potential impact of a large claim.

Financial Stability: Reinsurance promotes the financial stability of insurance companies by protecting them from insolvency. When a major disaster strikes, reinsurers are there, ready to absorb the impact, ensuring the continuity of business for primary insurers and protection for policyholders.

Influence on Pricing: By mitigating risk exposure, reinsurance guides insurers in product pricing, aiding in a strategic price determination. It helps in maintaining a balance between competitive premium rates and profitable risk management.

Reinsurance, in essence, is an indispensable ally to the insurance industry, reinforcing its capacity and strengthening its resilience.

What is Reinsurance?

Reinsurance is an imperative segment of the insurance industry. It acts as the insurance for insurers. It’s right! Insurance companies often need their form of insurance to spread risk and ensure they don’t run into financial strains.

Understanding the concept of reinsurance

Reinsurance becomes the buffer solution that allows insurance companies to manage their risks more effectively. Through reinsurance contracts, the original insurer can transfer a portion of its risks to the reinsurer, reducing the potential financial liabilities in the event of major calamities.

Different types of reinsurance contracts

Reinsurance comes in several types, majorly classified as treaty reinsurance that covers a portfolio of risks, and facultative reinsurance that applies to a single specific risk.

Reinsurance, therefore, plays a critical role in strengthening the insurance industry and contributing to its financial stability.

Benefits of Reinsurance

For an insurance company, multiple policies equal multiple risks. This is where reinsurance comes into play, bringing a number of benefits.

Enhancing the Financial Stability of Insurance Companies

Reinsurance is an exceptional tool used in bolstering the financial stability of insurance firms. By ceding a portion of their portfolio’s risk, insurers can withstand large and unexpected losses, ensuring the viability of the business.

Mitigating Risks and Catastrophic Events

Spread the risk, spread the loss! Reinsurance allows risks and losses to be distributed widely, minimizing the financial impact that unforeseen catastrophic events can have.

Increasing Capacity and Expanding Market Reach

Aside from risk management benefits, reinsurance increases an insurer’s capacity. It offers the ability to underwrite policies that cover larger risks while utilizing the insurer’s existing capital efficiently. This expansion in underwriting capacity can pave the way for a broader market reach, ultimately driving business growth. In a glimpsed nutshell, reinsurance operates as a safety net for insurance companies, safeguarding them from potential perils and opening doors to new opportunities.

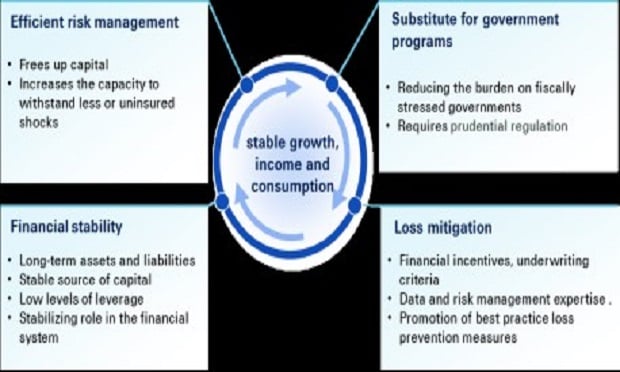

Functions of Reinsurance

Within insurance circles, reinsurance plays a vital role in maintaining the industry’s financial buoyancy. Arguably, its importance is fundamental.

Risk transfer and risk sharing

Reinsurance is an umbrella of protection for insurance companies. It allows the subdivision of large, potentially ruinous risks into manageable parts. This subdivision allows for the spreading of risk among multiple parties, making it tolerable.

Claims management and loss control

Beyond sharing risk, reinsurance helps to stabilize insurers’ claim costs, which enhances predictability. It also supports the reign in of large losses, contributing to the control of fluctuations in an insurer’s loss ratio.

Underwriting assistance and risk assessment

Lastly, reinsurance provides underwriting profit, crucial to the insurers’ bottom line. It also aids in assessing risk and determining pricing, which helps maintain the industry’s financial solvency and market competitiveness.

Reinsurance Market

Within the intricate fabric of the insurance industry, the role of reinsurance is monumental indeed.

Overview of the global reinsurance market

The bustling world of reinsurance is a vital cog that drives the insurance machine forward. As it facilitates the risk distribution across multiple players, it smoothens the journey for insurers, cushioning them from potentially catastrophic losses. The reinsurance market thrives on a global scale, with reinsurers absorbing part of the risks assumed by primary insurance companies. This phenomenon not only empowers the carriers to underwrite policies covering a larger volume of risks but also fosters stability in the insurance market by evening out the adverse effects of unexpected and large losses. It is, thus, an indispensable part of the insurance sphere.

GIPHY App Key not set. Please check settings