Introduction

When it comes to securing your financial future, there are several important factors to consider. One of these crucial elements is insurance. Insurance plays a vital role in financial planning, providing protection and peace of mind in the face of unexpected events. Understanding the role of insurance in financial planning is essential for individuals and families looking to safeguard their assets and ensure a stable future.

Importance of Financial Planning

Financial planning is the process of setting goals, creating a roadmap, and making informed decisions to achieve those goals. It helps individuals and families manage their finances effectively, save for the future, and build wealth. Financial planning provides a framework for making sound financial decisions, ensuring financial security, and achieving long-term objectives.

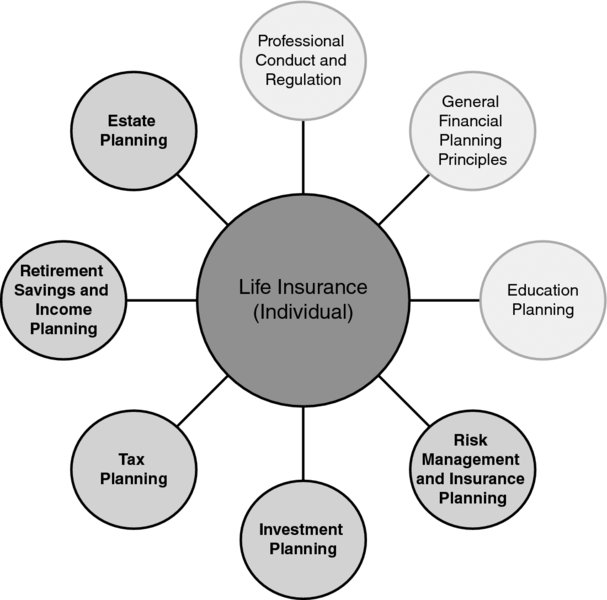

The Role of Insurance in Financial Planning

Insurance is an integral part of any comprehensive financial plan. It serves as a safety net, protecting individuals and families from potential risks and losses. Here are some key roles that insurance plays in financial planning:

- Risk Management: Insurance helps mitigate the financial impact of unexpected events such as accidents, illnesses, natural disasters, or death. It provides coverage for medical expenses, property damage, liability claims, and loss of income.

- Wealth Preservation: Insurance safeguards assets by providing compensation for losses or damages. It ensures that individuals and families can recover financially from unforeseen circumstances without depleting their savings or investments.

- Income Protection: Life insurance and disability insurance provide a source of income replacement in case of disability or death. This ensures that dependents are financially supported and can maintain their standard of living.

- Estate Planning: Insurance can be used as a tool for estate planning, ensuring the smooth transfer of assets to beneficiaries while minimizing tax liabilities.

By incorporating insurance into their financial plans, individuals and families can protect themselves against unforeseen events, preserve their wealth, and secure a stable financial future.

Understanding Insurance

What is Insurance and How Does it Work?

Insurance plays a crucial role in financial planning by providing protection against unforeseen events. It is a contract between an individual or business and an insurance company, where the insured pays a premium in exchange for coverage. In the event of a covered loss, the insurance company compensates the insured according to the terms of the policy.

Insurance works on the principle of risk pooling. By spreading the risk among a large number of policyholders, the financial burden of an individual’s loss is shared by the entire pool. This allows individuals to protect themselves against potentially devastating financial losses.

Types of Insurance

There are various types of insurance that cater to different needs:

- Life Insurance: Provides financial protection to beneficiaries in the event of the insured’s death.

- Health Insurance: Covers medical expenses and provides access to healthcare services.

- Auto Insurance: Protects against financial loss due to accidents or damage to vehicles.

- Homeowners/Renters Insurance: Offers coverage for property damage, theft, and liability.

- Business Insurance: Safeguards businesses against risks such as property damage, liability claims, and business interruption.

- Disability Insurance: Provides income replacement if an individual becomes disabled and unable to work.

- Liability Insurance: Protects against legal claims for bodily injury or property damage caused by the insured.

By understanding the different types of insurance available, individuals can make informed decisions about their financial planning needs and ensure they are adequately protected against potential risks.

Insurance and Risk Management

Identifying Risks in Financial Planning

When it comes to financial planning, it is crucial to identify and mitigate potential risks that could impact your financial stability. Risks such as unexpected medical expenses, property damage, or loss of income due to disability or death can have significant financial consequences. By recognizing these risks, you can take proactive steps to protect yourself and your loved ones.

How Insurance Mitigates Risks

Insurance plays a vital role in mitigating financial risks. It provides a safety net that protects against unforeseen events and helps individuals and businesses recover financially. By paying regular premiums, policyholders transfer the risk of potential losses to the insurance company. In return, the insurance company provides compensation or coverage for the specified risks, helping individuals and businesses manage their financial obligations during challenging times.

Whether it’s health insurance, life insurance, property insurance, or liability insurance, having the right coverage ensures that you are financially protected against unexpected events. It brings peace of mind and allows you to focus on your financial goals without worrying about the potential risks that could derail your plans.

In conclusion, incorporating insurance into your financial planning is essential for safeguarding your financial future. By identifying risks and obtaining appropriate coverage, you can protect yourself, your loved ones, and your assets from potential financial hardships.

Life Insurance

Importance of Life Insurance in Financial Planning

Life insurance plays a crucial role in financial planning by providing financial security and protection for your loved ones in the event of your untimely demise. It ensures that your family is financially stable and can maintain their standard of living even after you are gone. Life insurance can cover various expenses such as mortgage payments, education costs, and daily living expenses. It also acts as an income replacement for your family, ensuring that they can continue to meet their financial obligations.

Types of Life Insurance Policies

There are different types of life insurance policies available to cater to different needs and financial goals. These include term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type offers unique features and benefits, allowing you to choose the one that aligns with your specific requirements. It is essential to assess your financial situation, future goals, and the needs of your dependents before selecting a life insurance policy.

Remember, life insurance is not only a means of protection but also an integral part of a comprehensive financial plan. By including life insurance in your financial strategy, you can ensure the well-being and financial stability of your loved ones even when you are no longer around.

Health Insurance

Significance of Health Insurance in Financial Planning

Health insurance plays a crucial role in financial planning by providing protection against unexpected medical expenses. It ensures that individuals and families have access to quality healthcare without depleting their savings or going into debt. With rising healthcare costs, having health insurance coverage is essential for safeguarding one’s financial well-being. It provides peace of mind and allows individuals to focus on their health rather than worrying about the financial burden of medical treatments and hospitalization.

Types of Health Insurance Plans

There are various types of health insurance plans available to cater to different needs and budgets. These include individual health insurance, family health insurance, group health insurance, and government-sponsored plans like Medicare and Medicaid. Each plan offers different levels of coverage, benefits, and premiums. It is important to carefully evaluate and choose a plan that aligns with your specific healthcare needs and financial goals.

Remember, investing in a comprehensive health insurance plan is not just a smart financial decision but also a proactive step towards protecting yourself and your loved ones from unforeseen medical expenses.

GIPHY App Key not set. Please check settings