Importance of Comprehensive Insurance Coverage

Presenting a need to understand and appreciate the indispensable role of comprehensive insurance coverages for the modern individual. This coverage goes beyond the regular, covering wide-ranging perils that the insured may encounter. Of course, the whole concept can be a bit complex to navigate, but there’s no need to worry.

Understanding the Need for Comprehensive Insurance

In the current times, the world is riddled with uncertainties. Any moment, anything can happen. In such instances, comprehensive insurance acts as a safety net. It provides the insured with an umbrella of financial security, covering the damages caused by unpredictable events such as fire, theft, or any other non-collision related incident. You can liken it to a shield, ensuring peace of mind for individuals and also for businesses.

Benefits of Comprehensive Insurance

Committing to comprehensive insurance is indeed a wise choice. It offers a broad spectrum of coverage that includes theft, vandalism, natural disasters, and damage caused by animals. Furthermore, it can cover for repair or replacement costs after an incident that doesn’t involve a collision. Simply put, it’s a prime investment to safeguard against all potential risks and damages, helping you stay secure and stress-free.

Vehicle insurance, especially, has vast benefits if chosen comprehensively. Such coverage gives the confidence to handle unforeseen situations without creating a financial burden. This type of insurance not only protects the owner but also secures third-party liabilities.

So whether it’s an individual or an enterprise, comprehensive insurance would indeed prove to be a worthy investment, delivering absolute peace of mind and sound financial health.

Exploring Different Types of Insurance

When it comes to protection against unforeseen circumstances, insurance policies are solid financial instruments that are worth considering. From health to auto, carefully choosing the type of insurance that suits one’s needs can significantly reduce financial stress.

Overview of Health Insurance

Health insurance is an absolute necessity today. It provides coverage for routine check-ups, emergency medical services, and preventive care, ensuring that high medical costs are not a hindrance in receiving adequate medical attention. It can be individual or group insurance, employer-sponsored, or purchased privately. Having health insurance not only gives peace of mind but also protects one’s savings.

Understanding Auto Insurance

Auto insurance, on the other hand, is the guardian of your vehicle. It comes in handy during incidents like accidents, theft, or damages caused due to natural disasters. An auto insurance policy ensures that you do not bear the brunt of these unexpected expenses. Basic auto insurance coverage includes liability insurance, collision insurance, and comprehensive insurance. Each type offers a unique level of protection tailored for different situations on and off the road, highlighting the importance of understanding your specific needs before purchasing a policy.

To empower oneself with comprehensive insurance information is to take proactive steps towards financial stability and peace of mind.

Navigating Home Insurance Policies

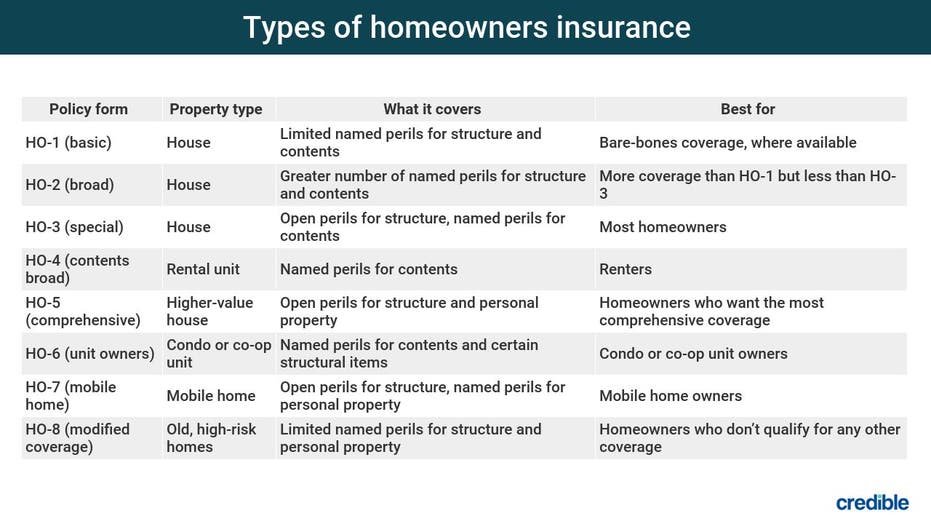

Home insurance policies, like a safety blanket, shield homeowners from several unexpected perils, from property damage to theft, and even liability lawsuits. But, the task of choosing the best insurance policy might feel overwhelming for those who are unaware of the comprehensive protection these policies offer.

Features of Homeowners Insurance

Homeowners insurance provides coverage that’s more than meets the eye. Beyond safeguarding the physical structure of your home, this policy usually extends to outbuildings like sheds or detached garages. It also covers your home’s contents, from your electronics to clothing.

Moreover, if your home becomes uninhabitable due to a covered peril like a destructive fire, homeowners insurance generally includes loss of use coverage. This covers additional living expenses you incur while your home is being repaired or rebuilt.

Understanding Renters Insurance

Renters insurance, often overlooked, is equally compelling, offering crucial protection for those who rent their living spaces. It covers your personal belongings – electronics, furniture, or jewelry – from perils like theft or fire. Additionally, it offers liability coverage, coming to your rescue if a guest injures themselves at your rented home.

In essence, both homeowners and renters insurance provide much-needed financial protection, empowering you amid hardships. Their importance cannot be understated, making them a critical part of managing and mitigating risks.

Protecting Your Business with Insurance

Navigating through the complexities of business insurance can sometimes seem like a daunting task. Yet, understanding and gaining comprehensive insurance information can empower business owners to make informed decisions that safeguard their firm from unforeseen circumstances.

Overview of Business Insurance

Business insurance comes configured in many forms, each designed to offer different forms protection. These include general liability insurance, information breach, property insurance, workers’ compensation, auto insurance, and others depending on the nature of their company’s operations. By understanding the distinct types of coverage, entrepreneurs can secure adequate insurance protection tailored to their unique needs.

Understanding Liability Insurance

The spotlight now switches to liability insurance, a crucial type of business policy that offers protection against potential legal claims and lawsuits. A misstep in your company’s operations might lead to a customer’s bodily injury, property damage, or claims of negligence. Liability insurance shields against such financial adversity, providing resources for legal defense and coverings costs if your business is found at fault.

Closing Note: Thorough knowledge bodes well in the journey of protecting business interests. Through a deep understanding of comprehensive insurance information, savvy entrepreneurs can derive maximum benefit from their chosen insurance policies and preemptively fortify their businesses against unexpected events.

Conclusion

The quest for a concise, yet comprehensive understanding of insurance often poses a significant challenge to many, from individuals to large corporations. Nonetheless, the power gathered through an extensive knowledge of insurance cannot be overstated.

The Power of Being Informed

Being informed about insurance practices, terminologies and policies translates to immense power. This is not just power over one’s financial safety but also of one’s life and assets in general. It allows one to make knowledgeable decisions, suiting personalized needs and wants, and navigate through life’s unpredictable tides with confidence.

Frequently Asked Questions

To further empower people, there are numerous FAQs that answer many people’s questions regarding insurance. Questions such as, what are the available types of insurance? Or, How does one file an insurance claim? These FAQs serve as a quick reference guide that build on existing knowledge and fill in gaps where necessary.

Finally, while it may seem a daunting task initially, confronting these insurance-related questions and topics head on could eventually lead to an empowered you. Thanks to the vast wealth of comprehensive insurance information available, gaining insight and control over your own insurance policies has never been more accessible. Armed with this knowledge, you can make confident decisions about your insurance needs.

GIPHY App Key not set. Please check settings