Introduction

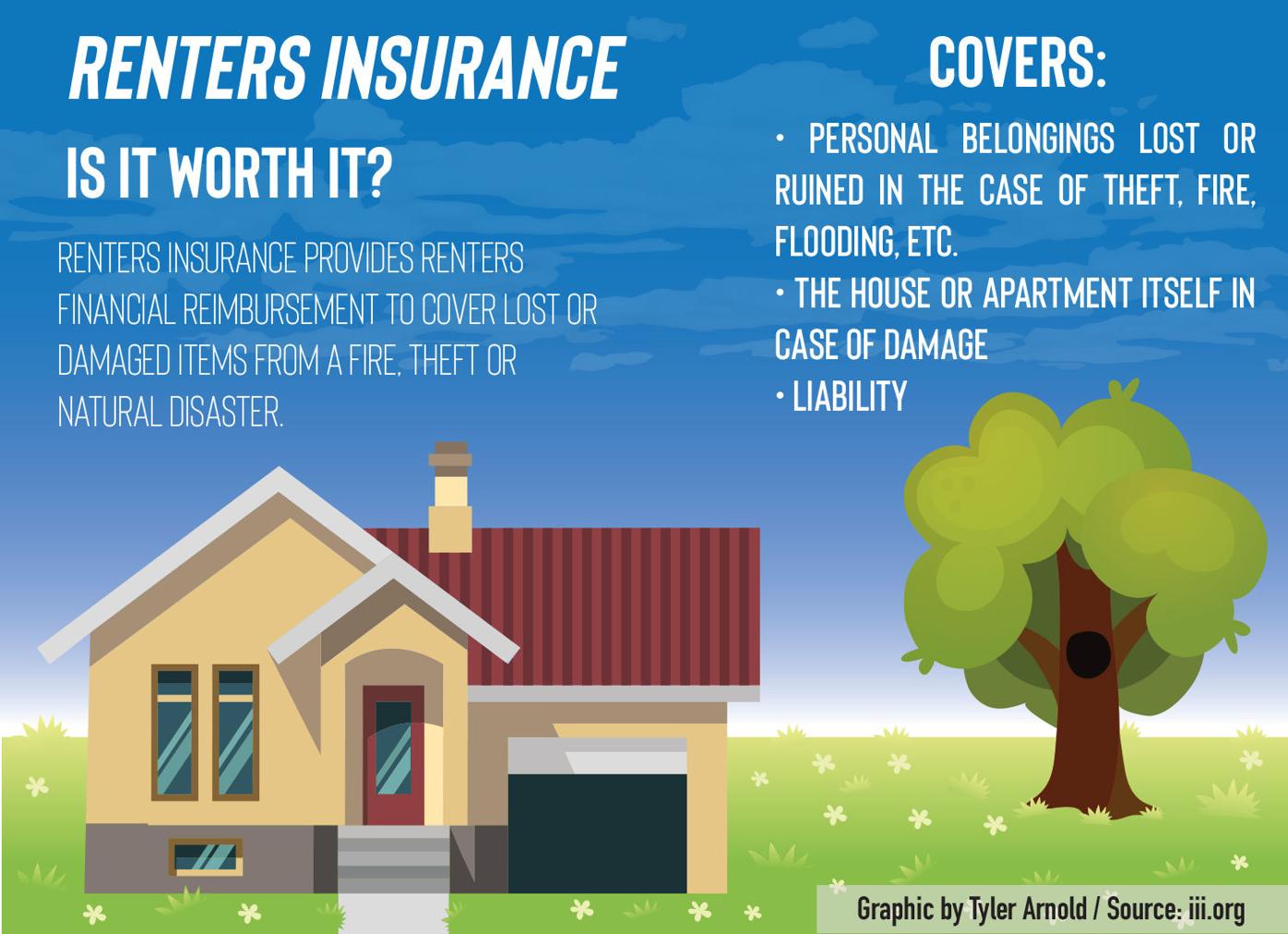

Most renters overlook the integral part renter’s insurance plays in safeguarding their personal property. They perceive it as an extra cost, without understanding its substantial benefits.

What is renter’s insurance and why is it important?

Renter’s insurance provides protection for your possessions against disasters. It plays a pivotal role in compensating you in the event of a loss or damage.

Common misconceptions about renter’s insurance

Renter’s insurance isn’t expensive: The average cost of renter’s insurance is affordable, contrary to common perception. It is an indispensable investment that provides unparalleled peace of mind for tenants.

Coverage and Benefits

When it comes to safeguarding personal belongings, renter’s insurance strikes as a worthy investment.

Understanding the coverage provided by renter’s insurance

Renter’s insurance typically covers theft, vandalism, and damage from natural disasters. It makes replacing individual items less financially crippling and offers a sense of security.

Benefits of having renter’s insurance for personal property protection

The benefit of personal property protection is invaluable. It not only covers the cost of lost or damaged items, but also ensures peace of mind knowing you’re sheltered from unexpected loss.

Types of Coverage

Renters insurance offers a plethora of coverage, ensuring that your personal property remains protected.

Actual Cash Value (ACV) vs Replacement Cost Value (RCV)

Two key types include Actual Cash Value, which compensates you for the item’s value at the time of loss, and Replacement Cost Value, paying out what you’d spend to buy a new, similar item.

Additional coverage options and endorsements

Beyond these, renters can opt for tailored coverage via options and endorsements, expanding protection scope to suit unique needs.

Factors to Consider

In the realm of renting, considerable attention is often given to the property itself but the value of what’s inside shouldn’t be underestimated.

Factors to consider when choosing a renter’s insurance policy

Choosing a renter’s insurance policy is a crucial undertaking that requires in-depth analysis of what the policy covers, the policy’s limits and premiums, to ensure they align with one’s specific needs.

Determining the appropriate coverage limits

Identifying the right coverage limits takes into consideration the total value of personal belongings. It’s essential to perform an inventory of possessions and assign an appropriate value to each, helping to determine an adequate coverage limit.

Making a Claim

In the unfortunate event of a loss or damage to your personal property, renter’s insurance becomes indispensable.

The process of filing a claim for renter’s insurance

Initiating a claim is the first step toward obtaining due compensation for your loss. Getting prompt, factual reporting ensures your insurance company can begin assessing your case sooner.

Tips for maximizing your claim settlement

To maximize your claim settlement, document every item lost immediately with the date, value, and any additional details. A well-detailed inventory can facilitate the claim process and maximize your compensation.

Saving Tips

In the world of renting, ensuring that personal property is covered by renter’s insurance is a must. Still, maintaining a budget is crucial. Being strategic about policy selection can lead to significant savings.

How to save money on renter’s insurance premiums

Strategizing deductible amounts, and grouping policies are a few ways to save on renter’s insurance premiums.

Discounts and incentives offered by insurance providers

From bundling insurance packages to using security devices in your rented space, discovering ways to qualify for discounts and incentives can lead to notable reductions on renter’s insurance costs.

Renters Insurance vs Landlord’s Insurance

When it comes to protection for property, both renters insurance and landlord’s insurance serve distinct roles. The primary differentiation between the two lies in what is covered. Landlord’s insurance typically protects the property structure and potential legal liabilities while renter’s insurance provides protection for the tenant’s personal belongings, and covers their potential liabilities within the property.

Understanding the differences between renter’s insurance and landlord’s insurance

The distinctions are necessary for creating a balanced insurance protection plan. Landlords insure their physical property along with any liability within it, but it won’t cover tenants’ personal effects.

Why renter’s insurance is necessary even if the landlord has coverage

This brings us to why renter’s insurance is crucial. Even with a landlord’s insurance, personal items are not covered. Hence, a separate renter’s insurance ensures that in case of theft, fire or other damages, tenants can claim for their personal belongings or any liability they might face within the rented premises.

Real-Life Scenarios

In practical circumstances, renter’s insurance has proven to be immensely beneficial. Two such instances are vividly captured in the following case studies.

Case studies showcasing the importance of renter’s insurance

Jane, a young professional, experienced a break-in, losing costly electronics. Fortunately, her renter’s insurance policy covered the financial setback. Meanwhile, an unforeseen fire razed John’s apartment, with renter’s insurance helping him replace lost possessions.

How renter’s insurance can save you from financial loss

Forget the assumption that landlords’ insurance will cover you. To protect your personal items – from clothing to electronics – you need renter’s insurance. Not only does it cover theft or damage due to uncontrollable events like fires, but it can also potentially save you thousands in financial loss.

Conclusion

With a myriad of unseen risks, it’s importance for tenants to step up their preparedness game. Acquiring a renter’s insurance is a positive stride towards mitigating potential financial losses that can result from damages or theft.

Taking the necessary steps to protect your personal property with renter’s insurance

Renter’s insurance serves as a shield, protecting your personal possessions from any unforeseen circumstances. It offers the peace of mind, knowing that your property is safeguarded reliably.

Final thoughts and recommendations

In conclusion, the importance of renter’s insurance cannot be overlooked. It’s a recommended safety net for every tenant. Because in the end, peace of mind and security is what we all strive for.

GIPHY App Key not set. Please check settings